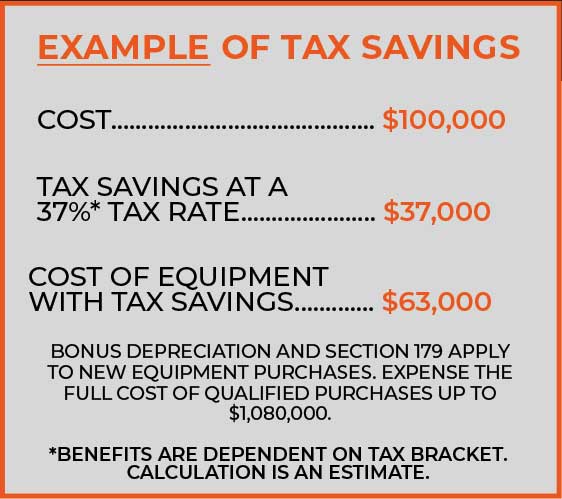

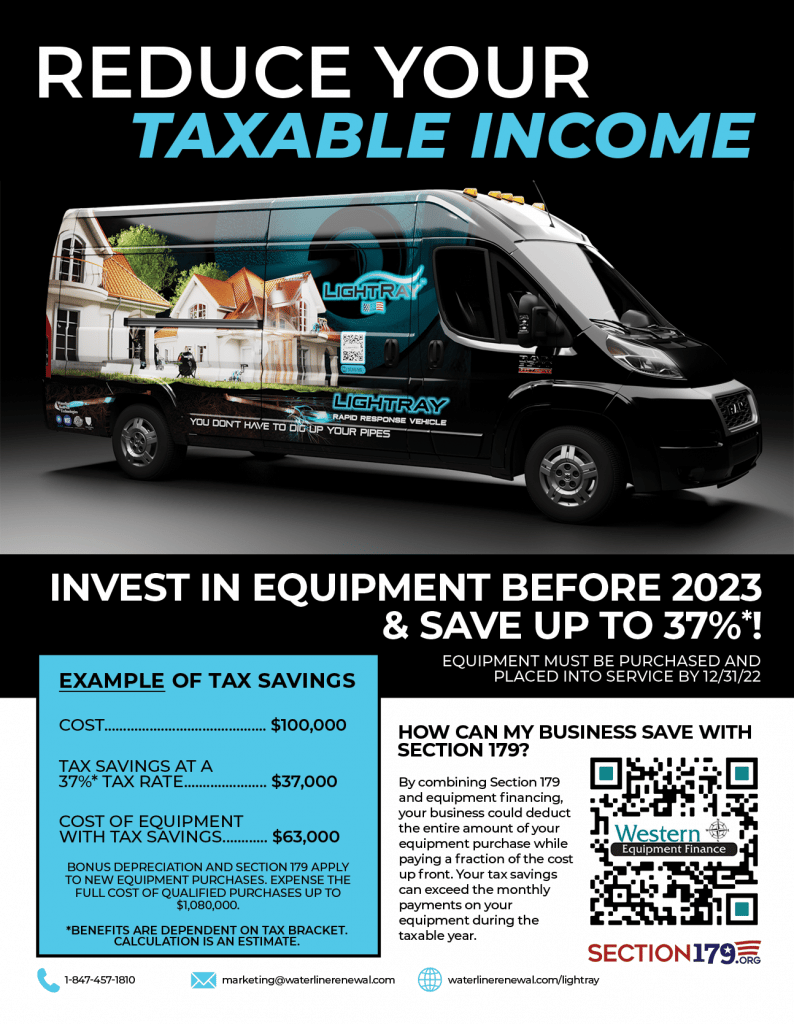

Section 179 Benefits. For many of us in business, It’s budget season. While planning for the coming year, it’s important to take stock of what you will need to grow your business. One very important program we advise customers of, as the year ends is Section 179. The program is based on a tax code, which is always very complicated, but what isn’t complicated is understanding how the program can benefit you.

The overall Section 179 benefit largely depends on your tax bracket since the tax bracket determines your deduction. Business owners who acquire equipment for their business such as equipment, vehicles and other tangible goods, may elect to take the entire deduction in the first year, instead of small deductions over time. By combining Section 179 and equipment financing, your business could deduct the entire amount of the equipment purchase while paying a fraction of the cost upfront. Your tax savings can exceed the monthly payments, in some cases, on your new equipment during the taxable year.

Contact us today to discuss your equipment needs including our new LightRay Rapid Response Vehicle, Quik-Coat AIPPR system and other premier products. Register for our December 6th Open House and see the technology in action with our full day of demonstrations.